Managing 108 F&B brands across 1,100+ outlets, we kept seeing the same pattern. It wasn't a technology problem. Everyone had systems—POS, delivery platforms, payment processors, banks, accounting software. The problem was what happened between those systems.

The answer was usually: spreadsheets.

The Middle Ground Problem

Here's how finance typically works at a multi-outlet F&B operator:

Data comes in from everywhere. POS says you sold $50,000 yesterday. GrabFood says they'll settle $8,200 in three days. The bank shows a deposit of $47,300. Your accounting system needs a journal entry by month-end.

None of these systems talk to each other. So someone—usually your finance team—sits in the middle and reconciles manually. They download reports, reformat columns, match transactions line by line, chase discrepancies, and eventually produce numbers that can go into the GL.

This is the middle ground: the space between your source systems and your system of record.

At 10 outlets, it's manageable. At 30+, it becomes a full-time job. At 50+, you're hiring people just to process data—not analyze it, not improve operations, just move numbers from one place to another.

The middle ground has no automation. No business rules. No exception handling. No audit trail. Just spreadsheets, email chains, and hope.

What Banking Figured Out Decades Ago

This problem isn't unique to F&B. Banking solved it a long time ago.

When you swipe your card, the transaction doesn't go straight to your bank's general ledger. It flows through a transaction processing layer—systems that consolidate, validate, match, and settle before anything hits the books.

This layer handles:

- Consolidation — Transactions from thousands of merchants, ATMs, and channels flow into one place

- Matching — Debits match credits, settlements match authorizations

- Exception handling — Anomalies get flagged and routed, not buried in spreadsheets

- Settlement — Clean, reconciled data pushes to downstream systems

The term for this is Straight-Through Processing (STP)—transactions flow from initiation to settlement with minimal manual intervention. The system of record receives clean, reconciled, ready-to-post data.

Your ERP shouldn't be where you figure things out. It should receive answers, not questions.

F&B operations generate the same complexity as banking—multiple channels, multiple payment methods, multiple settlement timings. But most operators are still processing it manually.

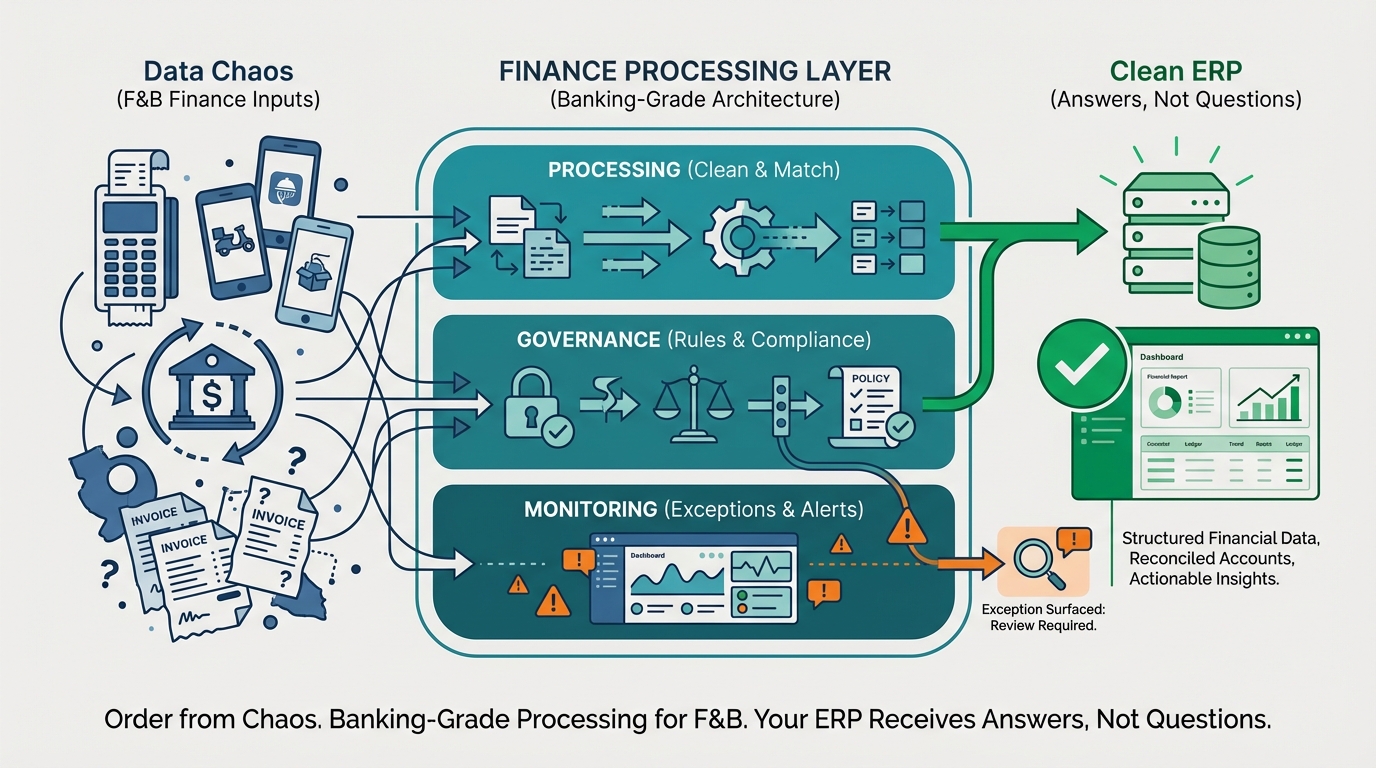

The Finance Processing Layer

What if F&B had the same infrastructure?

A layer that sits between your source systems and your ERP. Everything flows through it. Consolidation, matching, reconciliation, and posting happen automatically. Your finance team manages exceptions, not transactions.

This is what we call the Finance Processing Layer—and it has three dimensions:

1. Processing

Straight-through processing for finance operations:

- Consolidation — All revenue and cost data flows into one place, regardless of source format

- Matching — POS transactions match delivery settlements match bank deposits match GL entries

- Reconciliation — Discrepancies identified automatically, not discovered weeks later

- Posting — Journal entries generated and pushed to your accounting system

The goal: finance ops run automatically, not manually. Your team reviews and approves—they don't copy-paste.

2. Governance

Central control over business rules and processes:

- Business logic in one place — How revenue gets categorized, how costs get allocated, how exceptions get handled

- Approval workflows — Thresholds, routing, sign-offs built into the process

- Audit trails — Every transaction traceable from source to GL

- Change management — Update a rule once, it applies everywhere

No more business logic scattered across spreadsheets, macros, and tribal knowledge. One place to manage how your finance operations work.

3. Monitoring

Automatic visibility without asking:

- Exception dashboards — What needs attention right now

- Anomaly detection — Unusual patterns flagged before they compound

- Status tracking — Where is this transaction? Why hasn't it posted?

- Performance metrics — How long is reconciliation taking? Where are the bottlenecks?

You shouldn't have to dig for information. The system surfaces what matters.

What This Enables

When you have a processing layer, the downstream effects compound:

For AR (Revenue): Every sale, every delivery order, every payment—matched automatically. Exceptions surface immediately: missing deposits, settlement variances, unmatched transactions. Your team sees exactly what needs attention, not a wall of data to sift through.

For AP (Costs): Supplier invoices flow from scan to approval to payment. Price increases get flagged the moment they appear. Spend visibility across all outlets, all suppliers, all categories—with discrepancies called out, not buried.

For Analytics: Your data is already consolidated and clean. Ask any question—"Which outlet underperformed last week?" "Which supplier raised prices?" "What's my actual delivery platform margin?"—and get answers immediately.

For Month-End: What used to take 5+ days becomes a review process. The matching is already done. The exceptions are already surfaced. The journal entries are already generated. You're verifying and resolving, not building from scratch.

The Infrastructure Question

Every operator eventually faces this question: How do we scale finance operations without scaling headcount?

The answer isn't better spreadsheets. It isn't more accountants. It's infrastructure—a processing layer that handles the complexity automatically.

Banking built this infrastructure because they had to. The transaction volumes demanded it. F&B is reaching the same inflection point. Operators with 30, 50, 100+ outlets can't keep processing data manually.

The operators who build this layer will scale. The ones who don't will keep hiring.

What This Looks Like in Practice

You drop your reports into the system—POS exports, delivery platform settlements, bank statements, supplier invoices. The platform recognizes the formats, maps the data, runs the reconciliation, flags the exceptions, and generates the journal entries.

Your finance team reviews the exceptions. Approves the postings. Answers questions from the AI assistant. Analyzes trends instead of chasing data.

The processing layer handles the chaos. Your team handles the decisions.

That's the shift. From processing transactions to managing the business.

Want to see how this works? Reach out—we'll show you what a finance processing layer looks like for your operation.